Will the Real Estate Bubble Burst, or Will the Prices Keep Reaching the Sky?

Is this a good time to buy a home or invest in real estate? What is causing these insane prices? Let’s talk.

I’m in the process of buying a home, so I’ve been spending some time talking to real estate agents about the real estate market. They keep trying to convince me that real estate prices are only going up and will never again drop. The idea of a real estate market crash is apparently “haram,” or at the very least, a sign of mental retardation.

The impossible scenario.

It shocks people when I mention the possibility of a price correction of 20-30%. The nodding of disbelief and laughing to my face is getting old.

They all tell me a drop in real estate prices is absolutely impossible, as the demand is so high, there are no construction workers, and we just can’t build them fast enough.

Is that so? I beg to differ.

The central banks have unleashed their main weapons, raising the interest rates. These are weapons of mass destruction, though, and to have their desired effect, they must burn the market to the ground, not just halt it a bit. Think crashes and recessions, but hopefully not depressions.

2023 feels exactly like 2007.

At the time, I worked in real estate as a project manager overseeing new construction sales in Europe. New (and old) homes were selling like honey, with people coming to our office with bags of cash, begging to buy two or more apartments in any project available.

We literally raised prices every couple of months by 10%, and it didn’t matter one bit. The market ate it all! Nothing was too expensive. It was surreal!

Everybody, including the so-called experts, told us there was an immediate vacuum of thousands of apartments in my city alone (500,000 inhabitants, give or take). Even the real estate agents were flipping houses by doubling their money every few months with ease.

Remind me again, what year followed 2007?

Oh, yeah. The great financial crisis of our modern age. Do you still remember the fun of that era?

I sure as hell do. In a matter of days, it “was known” that we had tens of thousands of apartments in surplus on the supply side of the market and an absolute void of buyers. The market was filled with homes, but there were no interested or financially capable buyers left. It's interesting what a difference a few weeks makes. Isn’t it?

I remember it well as it was the year I lost everything: money, job, and health, barely escaping with my life.

The 2008 financial crisis came out of nowhere, and only Michael Burry (of ”Big Short” fame) seemed to have seen it. Did I mention the guy is shorting the market again? Well, truth be told, he appears to be a one-trick pony, and fighting the market is his game, but nonetheless, I can see his reasoning.

So, where are we today?

Everybody is buying real estate, and they simply can’t build them fast enough. Prices have skyrocketed in the last couple of years, to the tune of 30% per year, like it was nothing.

The market is euphoric, and if you know anything about market cycles, you know that this is not a good sign.

The prices, in my not-so-humble opinion, have skyrocketed because:

People have made “too” much money in the Covid and post-Covid era. Yes, some have lost money (myself included), but where I’m from, most have profited wildly. It's an interesting pandemic where everyone gets rich, and almost nobody dies.

Inflation is rampant. The official numbers of roughly 10% are a joke, and we all know it. In real-life terms, our purchasing power has been losing about 30% in a year in this past wave. Inflation is no longer just a financial term for the well-educated but the talk of the street.

The stock market has been going up for the past decade and has even accelerated in the past couple of years, giving birth to a whole line of people with newfound wealth.

The cryptocurrency market has spawned a lot of very “well-off” people who don’t know what to do with their money now, and the market has slowed down to a halt.

The historically low, even negative interest rates meant money was practically free in the last couple of years, making bank loans not only tempting but somewhat addictive.

Central banks holding hands with the governments have been acting like Robin Hoods and flooding the market with cash, quantitive easing, and all sorts of shenanigans to keep up the appearance that all is well. Nothing to see here. Move along!

Let’s look at a few charts.

The S&P 500 Index is still reaching for the top (dead cat bounce or new highs?):

Vanguard Real Estate ETF is in decline.

European Union House Price Index is in decline.

Prices might have officially begun to drop, but renters are in more pain than ever. Myself included, as I’m about to suffer another 15% raise at the end of the year.

Transaction numbers have fallen steeply in Germany, the leading powerhouse of Europe. You can find more interesting data on Germany’s real estate market here.

U.S. Real Estate Index ($DSRE) has shown some slowdown in the past year.

If you haven’t been living on the moon, the following charts will be familiar to you. The printing of new money has led to a significant rise in the money supply in the last couple of years. We’re all richer because we all have more money, right? Wrong!

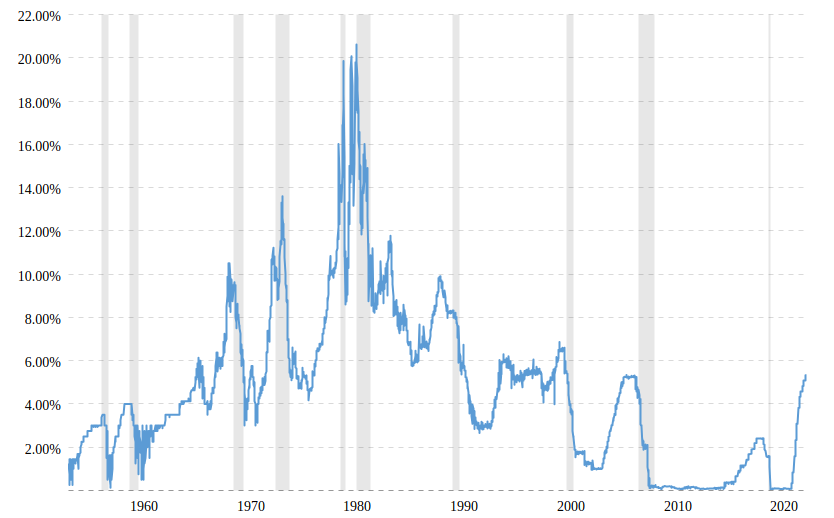

The historical chart of US interest rates is a lovely chart that shows three things:

We’ve had record-low interest rates that “pumped” everything.

There are some familiar dates following a steep rise in interest rates (hint: market crashes).

While current rates are high, they can always be higher if inflation doesn’t subside.

These charts depict the current state of debt within both US society and the government.

What happens next in the real estate markets?

I don’t know. Markets have a mind of their own and are not as predictable as we would like.

We can reason all we want, and even if we are right, we can easily miss the timing by a few years. We could also be completely wrong. Our information is always limited, not to mention the impossibility of predicting the future without a “time machine,” which I don’t have. Do you?

Predicting the future thing is rather pointless. I will say this, though:

It feels like every other market euphoria I’ve ever seen and experienced (my fourth one in various markets). No price is too high. To hell with rationality and cost analysis. Everyone is a buyer, and you can’t get anything for a reasonable price. Even the trashiest properties are deemed golden opportunities. People are buying in bulk. Nobody is willing to negotiate on prices or lower them. The prevailing consensus is that prices can only go up, never down anymore.

I am already seeing a slowdown in the market. I notice that the more expensive offerings are lingering much longer in the ads, some for months, even years, but reasonably priced ones disappear in a matter of days. There has also been a significant drop in new bank mortgages.

The inflation is supposedly slowing down (don’t take the official numbers literally; they have their own “special” math) as the central banks have unleashed their main weapons, raising the interest rates. These are weapons of mass destruction, though, and to have their desired effect, they must burn the market to the ground, not just halt it a bit. Think crashes and recessions, but hopefully not depressions.

Interest rates are getting high, making an already insanely expensive real estate even more unreachable. The apartments I was looking at have become about 30% more expensive for me in the past year—10% for the price rise and 20% for the increase in the cost of financing. Fun! So how much has our income risen? Oh yeah, zero!

The stock market hasn’t been allowed to pause and correct in a healthy way, and it is, in my opinion, overly pumped. That doesn’t mean it will necessarily crash; it could very well continue the bull trend, but the recipe for disaster is cooking up a specialty. In a debt-driven cycle-like economy, there need to be resetting periods to clear the books. One might be overdue.

Governments are in record debt all over the world. With rising interest rates, this can become troublesome. From what I’ve seen, consumer debt is equally high, much like it was in the aforementioned pre-financial crisis era.

Global politics are fragile at the moment, more so than at any time since the last Cold War, with a lot less competent leadership. Unexpected things can happen on the international stage, and I’m not expecting our leaders to start signing “kumbaya” holding hands anytime soon.

So, will the prices of real estate keep going up?

In the long run, probably. They usually keep up with inflation. There is always inflation, even if you can’t feel it directly (2% give or take). We’re talking decades here.

Trouble is not far away if the unexpected happens in the markets with this much debt in combination with high-interest rates.

Banks were already on the brink of capitulation, with a few large ones going under this past year. Once the dominos start falling, we might have to brace ourselves.

I suspect the governments will keep pressing the central banks to lower interest rates and begin quantitive easing anew, priming up the market for another record-high debt bull run, especially since we’re entering an election year. I could be wrong, though.

It takes guts to allow the markets to correct themselves and clear some debt out of the system.

Guts and intelligence, combined with the ability to think in decades, not just election cycles. Such long-term thinking is nowhere to be found these days. It’s a bit of a unicorn. Everything is about populism, elections, and catering to the desires of the masses.

I know the idea of a correction sounds terrible, but what happens if we skip this pressure valve a few times and the pressure builds up? Yes, you’re right - an explosion!

Now what?

If you’re buying a home for your family, it shouldn’t matter much.

Even if a price crash occurs, you still need to live somewhere, and if you stick with it for a couple of decades, even crashes tend to come back to pre-crash prices. Not always, but the odds are good for real estate.

The speculative buying using debt, though—those I would avoid at this time.

With investing in real estate, you make your profit by buying cheap and holding for a long time while renting, if possible. If you’re up to your eyeballs in debt, you might have to liquidate your investments at the worst possible time.

I often spot the top in a market but fail to make money on the coming crash.

It’s somewhat of a curse. I suspect the next one will follow the same pattern. I started investing in stocks and real estate in 2007 and went all-in into crypto in 2017. I am again trying to buy a home at what I suspect is the peak top of the market.

Not because I want to or believe it’s the best time, but because my ever-rising rent is beginning to choke me, and the prices of financing and owning a home are now the same as renting.

Plus, I have a family now and would like to move closer to my daughter’s grandparents so she might finally stop being afraid of them. COVID-era babies can be less socialized if they happen to have lived far away from family and were locked down for the most crucial years of their early development. Thanks for that, oh glorious medical experts. Job, well done. You might have screwed a generation, but you now own half the real estate market. An interesting spin on the Hippocratic Oath, I must admit.

Be well, friends, and I hope you have more luck with timing than yours truly.

Sharing is caring, especially in the online digital world.

You have my FULL PERMISSION to share, post, tweet, cross-post, and restack this content. In fact, I encourage it. If you would like to support my work by subscribing, sharing this post, or donating, follow this LINK and learn how. You are appreciated.